Credit Info

Empower your credit journey with credit info, expert guidance, and personalized solutions for financial success.

Sign Up TodayWhat is a Credit Score?

A credit score is a numerical prediction of creditworthiness, ranging from 300 to 850. Higher scores increase loan approval likelihood, while lower scores hinder it. Low scores mean higher interest rates, impacting mortgage, auto loan, and credit card expenses. A strong score can save thousands in the long run.

View OUr Success StoriesWhat affects your Credit Score?

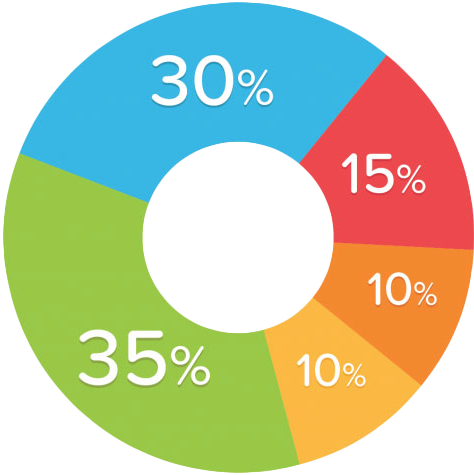

Payment History - 35%

On-time payments vs. delinquencies, more weight on the last 24 months

Capacity & Amount Owed - 30%

Percentage of credit limits available

Length of Credit - 15%

How long you've had your accounts

New Credit - 10%

Number of Inquiries & new accounts openend in the last 12-18 months

Types of Credit Used - 10%

Installment loans vs. revolving

Disputing Negative Payment History Items

- We will show you how to maximize your debt ratio score, even if paying off credit cards is not an option.

- We can also help you to remove credit inquiries from your credit report. Most people are aware of the three credit reporting bureaus, Equifax, Experian and TransUnion. The average difference in scores between the highest and lowest of your credit scores, from the three bureaus, is 60 points. This is the result of the credit bureaus having different items on their report, which may be correct, incorrect or are not reported in full compliance with credit law. According to a recent study, nearly 80% of all credit reports have serious errors on them and this does not even include the even smaller errors for which we look.

- If you cannot remove at least 25% of the negative credit items from all three of your credit reports, we will refund 100% of your fee.

Boosting Your Credit Score Beyond Credit Disputes

Timely Bill Payments

A key to credit improvement is paying your bills on time, every time. This includes your utility bills, mortgage and auto payments, and all of your revolving lines of credit like credit cards. Check your credit report at least once a year. At Fair Credit Advantage, LLC we will help you uncover strategies to challenge negative credit report data.

Long-Term Strategy for Credit Improvement

Keep your accounts open as long as possible – even if you are no longer charging on the card. The best policy is to keep those unused accounts open, blow the dust off your card every few months to make a small purchase, then pay it off. How long each of your accounts have been active is a major factor in your credit score.

Remember that this all takes time – Following the above steps consistently over a long period of time will increase your credit score and allow you to qualify for better loans and lower interest rates. Repairing your credit score does not happen overnight, so if you do these things for a few months and do not see a large increase in your score, do not give up. They are all habits that you will want to maintain throughout your life, as they will help you to keep your finances and lines of credit under control.

Master Credit Card Usage

Smart credit card management is a crucial step toward credit improvement. Maintaining balances below 30% is key. Demonstrating timely payments and maintaining several active, non-maxed-out cards is ideal. If high balances exist, prioritize paying them down. Strategic card usage is important. Avoid the misconception that avoiding credit use altogether is the solution. For those concerned about managing cards, consider a focused approach like using cards solely for utility bills, ensuring they're paid in full before the due date. This guarantees timely bill payments and cultivates a habit of balance clearance.

What's Excluded from Your Credit Report

- Medical information (unless you provide consent)

- Notice of bankruptcy (Chapter 11) more than ten years old

- Debts (including delinquent child support payments) more than seven years old

- Age, marital status, or race (if requested from a current or prospective employer)

Navigating the Intricacies of Credit Information

Understanding the various aspects of your credit report is essential for maintaining financial health and making informed decisions. If you have any questions or need further guidance, feel free to reach out to us. We're here to help you navigate the complexities of credit information and empower you on your journey towards financial success.

Contact Us Today